NV Form 3029 2001-2026 free printable template

Show details

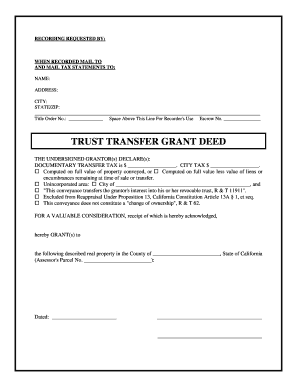

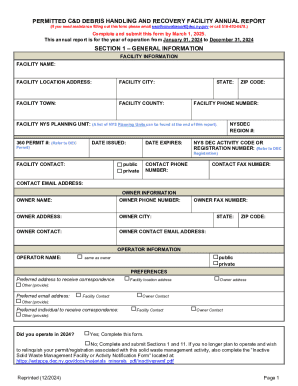

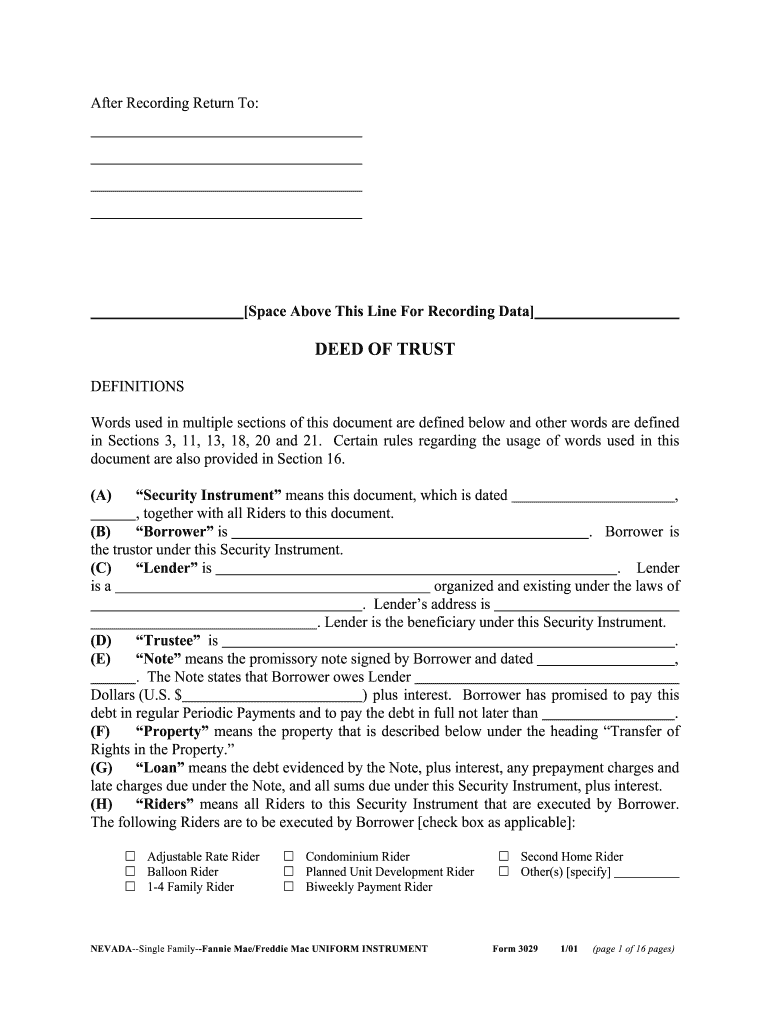

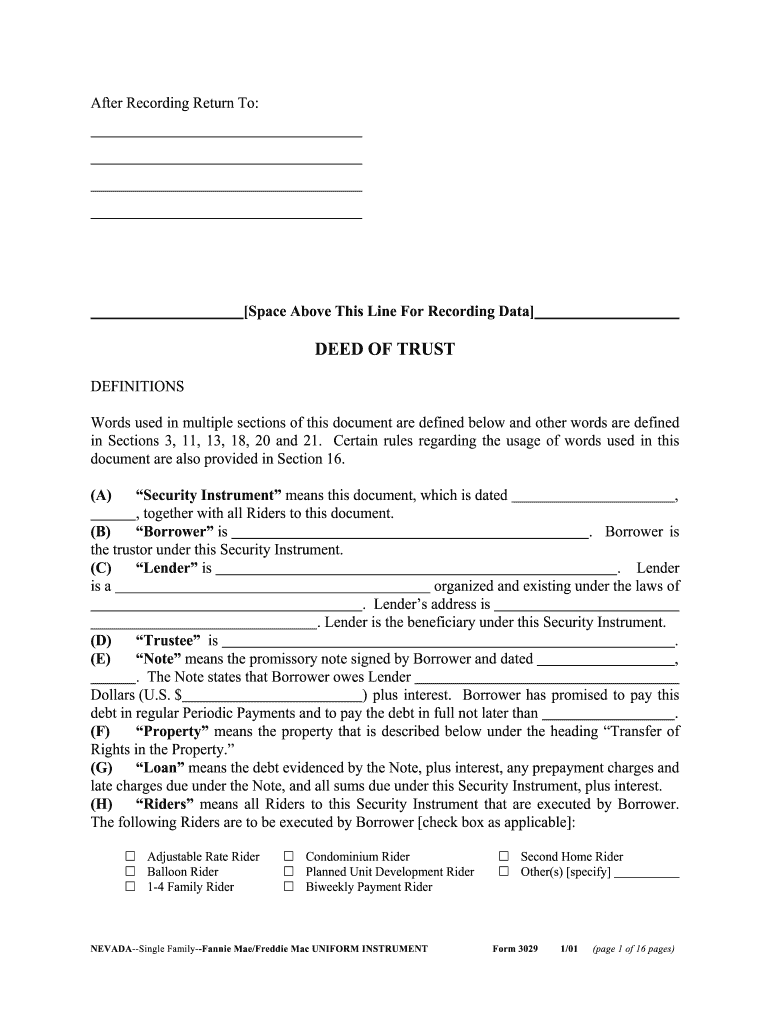

After Recording Return To: Space Above This Line For Recording Data DEED OF TRUST DEFINITIONS Words used in multiple sections of this document are defined below and other words are defined in Sections

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign nevada form deed trust

Edit your nv deed trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your trust transfer deed in las vegas form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit deed of trust preparation nevada online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit nevada deed of trust form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nevada living trust documents form

How to fill out NV Form 3029

01

Obtain NV Form 3029 from the official source.

02

Begin with filling out the applicant's personal information, including name, address, and contact details.

03

Provide the required identification numbers, such as Social Security Number or tax identification number.

04

Indicate the purpose of the form in the appropriate section.

05

Fill in any additional information requested, ensuring all entries are accurate.

06

Review the completed form for any errors or omissions.

07

Sign and date the form at the designated area.

08

Submit the form via the prescribed method (mail or electronic submission).

Who needs NV Form 3029?

01

Individuals or entities seeking to apply for a specific government service or benefit that requires this form.

02

Businesses that need to report specific information to the authorities as mandated by law.

03

Anyone instructed by government agencies to complete NV Form 3029 for compliance or reporting purposes.

Fill

freddie mac

: Try Risk Free

People Also Ask about nevada warranty deed form

Which deed is most commonly used in Nevada?

A Nevada grant, bargain, and sale deed form is authorized by statute and is the deed form most commonly used to transfer Nevada real estate.

Does Nevada use deed of trust?

In Nevada, lenders like a deed of trust (or “trust deed”) to give them security in case the borrower defaults. Some states use a mortgage for security, which is a two-party transaction involving both the lender and the borrower.

What is the form of Nevada deed?

Nevada law recognizes three general types of deeds for transferring real estate: a general warranty deed form; a grant, bargain, and sale deed form; and a quitclaim deed form. These three forms vary ing to the guaranty the current owner provides—if any—regarding the quality of the property's title.

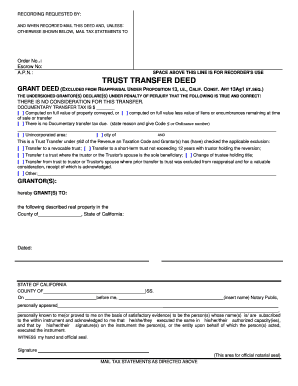

What is a deed of trust in Nevada?

A Nevada deed of trust is an agreement where a borrower signs over their property title to a trustee as collateral for a loan provided by a lender. If the borrower refunds the loan in full by the agreed-upon due date, the trustee will return the property title to the borrower.

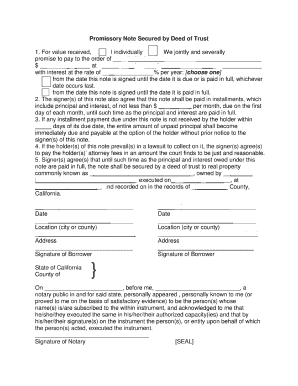

What is a note secured by deed of trust in Nevada?

A Deed of Trust is essentially an agreement between a lender and a borrower to give the property to a neutral third party who will serve as a trustee. The trustee holds the property until the borrower pays off the debt. The note lays out all the terms of the loan (repayment, interest, penalties, etc.).

What is the difference between a deed and a deed of trust?

The main difference between a deed and a deed of trust is that a deed is a transfer of ownership, while a deed of trust is a security interest. A deed of trust is used to secure a loan, while a deed is used to transfer ownership of a property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send nevada warranty deed to be eSigned by others?

Once your deed of trust nevada is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit nevada deed of trust in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing nevada life estate deed form and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I fill out land trust form using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign deed form and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is NV Form 3029?

NV Form 3029 is a form used in Nevada for reporting certain tax-related information, specifically regarding the state business license tax.

Who is required to file NV Form 3029?

Business entities operating in Nevada that are subject to the state's business license tax are required to file NV Form 3029.

How to fill out NV Form 3029?

To fill out NV Form 3029, businesses must provide their entity information, including the business name, address, and federal tax identification number, along with any additional required financial information relevant to the business license tax.

What is the purpose of NV Form 3029?

The purpose of NV Form 3029 is to ensure that businesses comply with state tax laws by accurately reporting and paying their business license taxes.

What information must be reported on NV Form 3029?

NV Form 3029 requires reporting of business income, gross receipts, and other financial information necessary to determine the business's tax liability.

Fill out your NV Form 3029 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Warranty Deed Nevada is not the form you're looking for?Search for another form here.

Keywords relevant to certificate of trust nevada

Related to nevada trust laws

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.